As the UAE continues to establish itself as a global business hub, one of the key areas that have seen significant changes is taxation. Dubai, known for its investor-friendly environment, offers numerous opportunities for both local and international businesses. However, with the introduction of various tax obligations like VAT and the upcoming corporate tax, navigating the complex tax framework can be daunting. This is where tax consultants become indispensable. In this article, we will explore why hiring a tax consultant in Dubai is essential for businesses and individuals alike.

1. Understanding UAE’s Tax Framework

Dubai’s tax environment has evolved over the years. Although the UAE remains relatively low-tax compared to other countries, businesses operating in Dubai must now adhere to several tax regulations, primarily VAT and corporate tax (starting in 2024). Understanding these regulations is critical to ensuring compliance.

- VAT (Value Added Tax): VAT is applicable to most goods and services in Dubai at a standard rate of 5%. Businesses are required to file VAT returns regularly and ensure they accurately calculate the tax due on their sales and purchases. Failure to comply can result in fines, penalties, and other legal consequences.

- Corporate Tax: Starting from 2024, the UAE will introduce a corporate tax of 9% on business profits exceeding AED 375,000. This move aims to diversify government revenue streams and align the UAE with global tax standards.

In addition to VAT and corporate tax, there are sector-specific tax regulations, import duties, and other government fees that businesses must comply with. These laws are continuously evolving, making it essential for businesses and individuals to stay informed. A tax consultant has in-depth knowledge of these tax regulations and can help clients navigate the complex tax landscape while ensuring full compliance with all tax obligations. Whether you’re dealing with VAT, corporate taxes, or import duties, a tax consultant provides crucial expertise to ensure your business adheres to the ever-changing tax laws and regulations.

Navigating these obligations can be complex, especially for new businesses or individuals unfamiliar with the tax system. A tax consultant helps ensure that companies and individuals stay compliant while also identifying opportunities to minimize tax liabilities.

2. What does a Tax Consultant do

A tax consultant is a professional who specializes in tax consulting, tax law, and compliance. Tax consultants help businesses and individuals understand their tax obligations, file returns, and optimize their tax strategies. The role of tax consultants extends far beyond basic compliance; they also offer critical advisory services, enhancing financial planning and decision-making. Whether you’re a business owner or an individual, working with a tax consultant can help you navigate complex tax regulations and achieve financial success. Expert tax consultants tailor solutions that align with your unique needs, ensuring you stay compliant while maximizing your tax benefits.

Here are some key responsibilities of a tax consultant:

- Tax Compliance: Ensuring that businesses and individuals meet all filing deadlines and regulatory requirements for VAT, corporate tax, and other applicable taxes. Compliance is not a one-time task but a continuous process of adhering to tax laws, maintaining accurate records, and making timely payments to avoid penalties.

- Tax Planning: Offering strategies to minimize tax liabilities legally. This might include restructuring business operations, taking advantage of tax deductions, or optimizing VAT recovery. A well-designed tax plan helps businesses grow sustainably while minimizing the tax burden.

- Representation in Audits: If a business or individual faces a tax audit, a tax consultant can represent them before the tax authorities, helping to manage the process and ensure a favorable outcome. They are adept at preparing the necessary documentation and defending clients from potential disputes or penalties.

- Advisory Services: Tax consultants offer ongoing advice on how to align financial strategies with tax regulations, whether for a business looking to expand or an individual managing their wealth. They provide insights that help clients make informed decisions about everything from mergers and acquisitions to estate planning.

- Claim Processing: Assisting clients in filing claims for tax refunds, VAT recovery, or other applicable rebates. A tax consultant ensures that claims are accurately prepared and submitted on time, maximizing the chances of approval and timely disbursement.

- Conflict Resolution: Managing and resolving tax disputes with authorities or third parties. Tax consultants help navigate complex legal frameworks, negotiate settlements, and find solutions that avoid prolonged litigation or financial penalties.

A tax consultant’s expertise encompasses not only compliance but also strategic tax planning. They work with businesses to ensure they are paying only what they owe, without overpaying or leaving potential savings on the table.

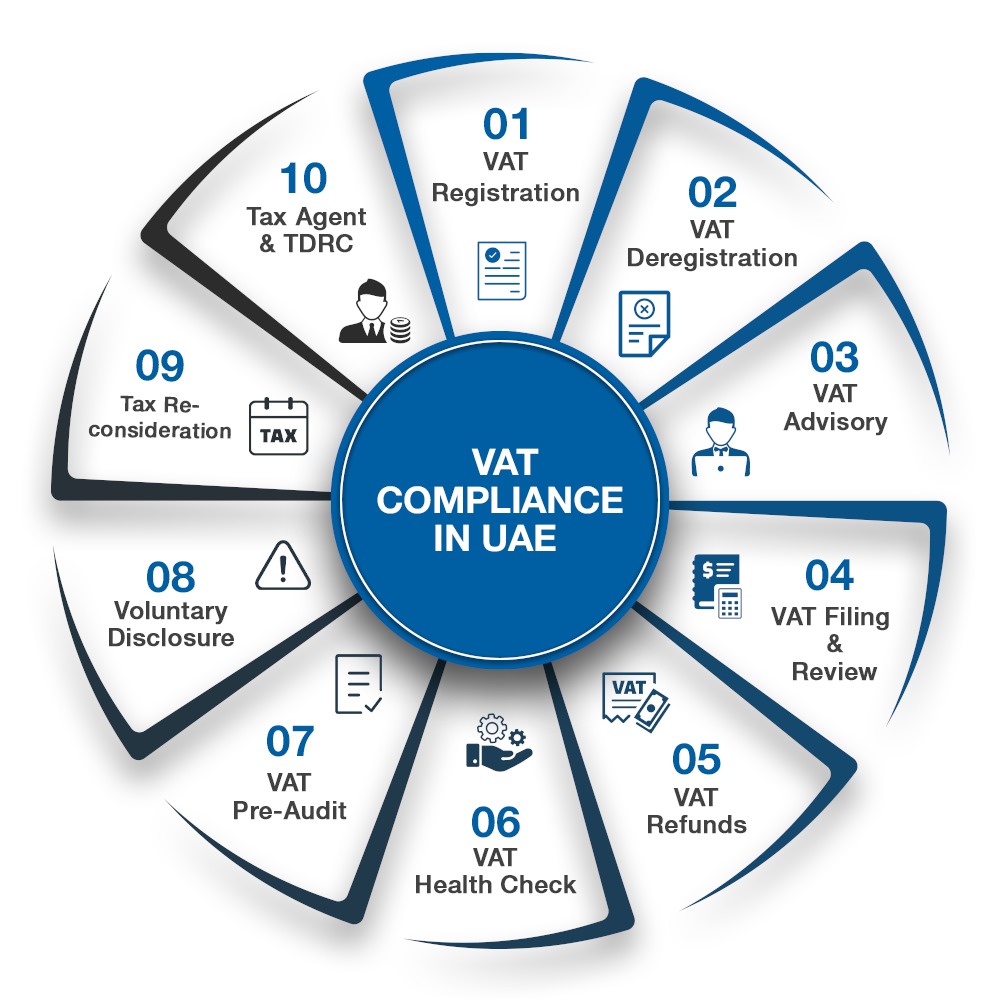

3. Key Concepts Mapped Out in This Article

4. Tax Planning Strategies

One of the key benefits of working with a tax consultant is the ability to plan proactively for future tax obligations. A tax consultant helps businesses forecast and manage these obligations, ensuring strategic financial planning. This proactive approach is especially important for businesses looking to expand, enter new markets, or make significant investments. By collaborating with a tax consultant, businesses can navigate complex tax laws, optimize their tax strategies, and ensure compliance while minimizing future tax liabilities. A skilled tax consultant plays a crucial role in helping businesses achieve long-term financial success.

- Long-term vs. Short-term Tax Planning: Tax consultants help businesses look beyond immediate tax savings. By adopting a long-term tax strategy, businesses can better manage their tax obligations over time and avoid the pitfalls of short-term decisions that may lead to higher taxes in the future. Long-term tax planning considers the full life cycle of the business and anticipates changes in tax laws, ensuring stability and predictability.

- Investment Planning: If your business is considering significant capital investments, a tax consultant can help you understand how these decisions will affect your tax liability. They can also advise on how to structure investments to maximize tax efficiency. Strategic investments in assets, technology, or real estate can lead to considerable tax savings, provided they are planned in advance.

A proactive approach to tax planning can save businesses substantial amounts of money while also ensuring compliance with all relevant laws.

5. VAT in Dubai for Strategic Business Growth

VAT remains one of the most significant tax obligations for businesses in Dubai. A tax consultant can help you navigate the complexities of VAT, ensuring that your business complies with all filing requirements while optimizing your VAT recovery.

- VAT Filing: Tax consultants assist businesses in filing accurate VAT returns. This includes ensuring that VAT is correctly calculated on all sales and purchases, and that the appropriate amount of tax is remitted to the authorities.

- VAT Refunds: For businesses that are eligible for VAT refunds (such as exporters or those dealing with zero-rated goods), a tax consultant can help maximize the amount recovered, improving cash flow.

- Compliance with VAT Regulations: VAT laws in Dubai can be complex, especially when it comes to determining whether goods or services are subject to VAT, or whether they qualify for exemptions or zero-ratings. A tax consultant ensures that businesses comply with these regulations, avoiding costly mistakes.

By offering expert guidance on VAT, a tax consultant helps businesses avoid errors in their filings while ensuring they take full advantage of the VAT refunds and credits available to them.

6. Corporate Tax in the UAE: Preparing for Upcoming Changes

With the introduction of corporate tax in 2024, businesses in Dubai will face new challenges. A tax consultant can help businesses prepare for these changes by ensuring that they are ready to comply with the new regulations and by developing strategies to minimize their corporate tax liabilities.

- Understanding Corporate Tax: The new corporate tax regime will apply a 9% tax on profits exceeding AED 375,000. A tax consultant helps businesses understand how the new law will affect their operations and profitability.

- Strategic Tax Planning for Corporate Tax: As businesses prepare for the introduction of corporate tax, a tax consultant can help them restructure their operations, investments, and profit distributions to minimize their tax burden.

By preparing early, businesses can avoid the rush and potential pitfalls that may come with the implementation of corporate tax.

7. Tax Audits and Disputes:

Facing a tax audit or dispute can be stressful, particularly if you are unfamiliar with the process or the specific regulations involved. A tax consultants plays a critical role in managing audits and disputes, ensuring that your business is properly represented and that any issues are resolved in your favor.

- Managing Tax Audits: Tax authorities in Dubai may audit businesses to ensure compliance with tax regulations. A tax consultant can help you prepare for an audit, ensuring that all records are in order and that the audit process goes smoothly. They will work with your internal accounting team to gather and present the necessary documents, ensuring that the audit runs smoothly without triggering unnecessary scrutiny.

- Prevention and Documentation: A proactive tax consultant ensures that businesses have well-maintained documentation and proper record-keeping, reducing the risk of triggering a tax audit in the first place. They will set up systems to ensure all financial statements, invoices, and tax filings are accurate and easily accessible, meeting the compliance standards required by the tax authorities.

- Resolving Tax Disputes: If a dispute arises, whether due to a misunderstanding or an error, a tax consultant can represent your business in negotiations with the tax authorities, working to resolve the issue and minimize any penalties. They bring in-depth expertise in tax law, helping to challenge wrongful claims and advocating for reduced fines if necessary.

- Post-Audit Assistance: Once an audit is concluded, a tax consultant can help interpret the findings and make necessary adjustments. If any penalties are imposed or corrective actions suggested, they work with you to ensure compliance with future audits, thus preventing future issues.

A tax consultant not only prepares you for potential audits but also mitigates risks that could lead to financial loss, preserving your business’s reputation and financial standing.

8. Why Individuals Need a Tax Consultant in Dubai

While much of the focus tends to be on businesses, individuals especially expatriates can also benefit from working with a tax consultant in Dubai. Expatriates often face unique challenges when it comes to tax planning, especially if they have assets in multiple countries or complex financial situations.

- Tax Planning for Expatriates: Many expatriates in Dubai come from countries with different tax systems, and navigating the tax obligations in both Dubai and their home country can be confusing. A tax consultant helps expatriates understand their tax obligations and develop strategies to minimize their tax liabilities across multiple jurisdictions.

- Global Taxation: Expats living in Dubai may face taxation in their home country, depending on their country of origin’s tax policies. U.S. citizens, for example, are required to file U.S. tax returns regardless of where they live. A tax consultant familiar with international tax laws can help expatriates understand how to meet their obligations without incurring double taxation or other penalties.

- Estate Planning and Wealth Management: Tax consultants also assist individuals with estate planning, ensuring that their wealth is preserved for future generations while minimizing estate taxes and other obligations. Estate planning is particularly important for high-net-worth individuals, as it ensures that assets are passed on efficiently, with minimal tax liabilities.

- Investments and Real Estate: Individuals who invest in real estate, both locally and internationally, can benefit from a tax consultant’s advice on how to structure their investments to optimize tax efficiency. This can include using holding companies, trusts, or other vehicles to minimize tax exposure.

By working with a tax consultant, individuals can ensure that their financial affairs are managed efficiently and that they are fully compliant with all tax regulations.

9. The Cost of Non-compliance: Penalties and Fines in Dubai

The penalties for non-compliance with tax regulations in Dubai can be severe. Tax consultants helps businesses and individuals avoid these penalties by ensuring that all returns are filed on time and that records are properly maintained. Fines and penalties can quickly accumulate if businesses fail to comply with VAT, corporate tax, or other regulations.

| Offense | Penalty |

| Failure to file VAT return on time | AED 1,000 for the first offense |

| Incorrect tax return submission | Up to 50% of the unpaid tax amount |

| Failure to keep accurate records | AED 10,000 for the first offense |

The fines listed above represent only a fraction of the potential costs businesses can incur if they are found to be non-compliant. Non-compliance can also lead to reputational damage, legal fees, and lost business opportunities. A tax consultant ensures that businesses avoid these pitfalls, saving both time and money in the long run.

10. Technology in Tax Consulting: The Future of Compliance

The world of tax consulting is undergoing a transformation, with digital technology playing a crucial role in ensuring compliance and streamlining tax processes. As businesses in Dubai, and globally, grapple with increasingly complex tax regulations, tax consultants are turning to cutting-edge tools and software to enhance efficiency, accuracy, and overall performance. The integration of automation, cloud computing, and artificial intelligence (AI) is changing how tax consultants approach compliance, risk management, and client advisory services. In Digital Transformation in Taxation by Tatiana Falcao, the author explains, “Technology is not merely a convenience in tax compliance—it is becoming a fundamental necessity for modern tax professionals.”

Automation in Tax Filing

Automation tools have become indispensable for tax consultants, helping them file returns faster and with greater accuracy. By using tax automation software such as Thomson Reuters ONESOURCE or Avalara, consultants can process vast amounts of tax data in real-time, significantly reducing the risk of manual errors. Automation not only simplifies the data entry process but also ensures that businesses remain compliant with ever-evolving tax regulations.

As explained in Tax Technology: A Practical Guide by Will Farnell, “The automation of tax filing has revolutionized the industry by providing consultants with powerful tools to streamline processes, from input to submission.” Automated systems flag inconsistencies, notify consultants of deadlines, and offer real-time updates on regulatory changes. For businesses, this means fewer missed deadlines and penalties, along with more opportunities for tax savings.

Digital Solutions for Record Keeping

Accurate record-keeping is the backbone of tax compliance, and digital tools have made it easier than ever for businesses to maintain comprehensive and organized financial records. With platforms like Xero, QuickBooks, and SAP Concur, tax consultants can help clients securely store and manage their financial data in the cloud. These solutions ensure that businesses can access their records in real time, whether for an audit, tax filing, or internal review.

In Cloud Accounting: A Guide for Tax Professionals by Mathew Hack, the author highlights that “cloud-based record keeping allows for seamless access to historical data, offering a more dynamic approach to tax audits and reporting.” The real-time synchronization of data means that consultants and business owners alike can review, update, and track financial records with ease, leading to greater transparency and preparedness when it comes to tax compliance.

Predictive Analytics and AI

Predictive analytics and artificial intelligence (AI) are at the forefront of the technological revolution in tax consulting. These technologies help tax consultants forecast potential tax liabilities, identify risks, and even anticipate regulatory changes. Tools like IBM Watson andKira Systems are examples of AI-powered platforms that assist consultants in analyzing large datasets to uncover patterns and trends that may signal audit triggers or compliance issues.

According to Artificial Intelligence in Tax by Keith Gates, “AI is enabling tax consultants to move from reactive to proactive roles, helping businesses not only comply with current tax regulations but also anticipate future challenges.” Predictive analytics can analyze historical data and industry trends to offer insights that help businesses make informed decisions about tax planning, helping them mitigate risks before they escalate into significant issues.

The Future of Tax Consulting: Embracing Digital Transformation

The future of tax consulting is undoubtedly digital. As consultants continue to adopt advanced tools like automation, cloud computing, and AI, businesses that embrace these technologies will be better equipped to handle their tax obligations efficiently and accurately. By automating routine tasks, maintaining real-time records, and leveraging AI for predictive analysis, tax consultants can offer a higher level of service; ensuring businesses stay compliant while minimizing risks.

A forward-thinking tax consultant can provide businesses with cutting-edge solutions, helping them stay ahead of tax obligations and capitalize on opportunities for efficiency. As highlighted in The Digital Transformation of Tax by Tatiana Falcao, “Businesses that embrace digital tax technologies are not only future-proofing their compliance strategies but are also unlocking new levels of operational efficiency.”

By integrating these tools into their processes, consultants are offering smarter, faster, and more reliable services—allowing businesses to focus on growth while ensuring they remain fully compliant in an ever-changing regulatory landscape.

11. Choosing the Right Tax Consultant in Dubai

Selecting the right tax consultant is critical to ensuring that you receive the best possible advice and service. Here are some factors to consider when choosing a tax consultant:

- Experience and Expertise: Look for a tax consultant with extensive experience in Dubai’s tax laws, particularly VAT and corporate tax. An experienced consultant will be familiar with the nuances of Dubai’s regulations and will be better equipped to offer tailored advice that suits your specific needs.

- Local Knowledge: Dubai’s tax regulations are unique, so it’s essential to work with a consultant who has in-depth knowledge of the local market. Local knowledge ensures that your tax consultant understands the specific challenges businesses face in Dubai, from VAT compliance to corporate tax planning.

- Reputation and References: Ask for references from other clients and look for a consultant with a strong reputation for reliability and professionalism. A good tax consultant will have a proven track record of helping businesses save money and avoid penalties.

By choosing the right tax consultant, you can ensure that your business is not only compliant with Dubai’s tax regulations but also positioned for long-term success.

12. Tax Consultancy for Startups and SMEs in Dubai

For startups and small businesses, tax planning can be particularly challenging. Limited resources and unfamiliarity with the tax system can lead to costly mistakes. A tax consultant helps SMEs navigate these challenges by providing tailored advice and services.

- VAT Compliance for SMEs: Many small businesses struggle with VAT compliance due to the complexity of the rules. A tax consultant ensures that SMEs file accurate returns and take advantage of any available tax-saving opportunities.

- Growth Planning: As small businesses grow, their tax obligations may change. A tax consultant helps businesses plan for growth, ensuring that they remain compliant with tax laws while maximizing profitability. This is particularly important for businesses that plan to scale operations, as they may face new tax challenges as they expand.

13. How a Tax Consultant Fits Into Your Overall Financial Strategy

A tax consultant is not just a specialist who deals with taxes they are an integral part of your broader financial strategy. By working closely with your accountant, financial advisor, and legal team, a tax consultant ensures that your tax strategy is aligned with your overall financial goals.

For example, if your business is planning to expand internationally, your tax consultant can provide advice on how to structure your operations to minimize taxes while ensuring compliance with both local and international tax laws. If you are an individual looking to invest in real estate, your tax consultant can help you understand the tax implications of your investment and develop a strategy that maximizes your returns.

A well-rounded financial strategy considers the short-term and long-term tax implications of every financial decision, and a tax consultant helps you navigate the complexities of these decisions.

14. Why Every Business and Individual Needs a Tax Consultant in Dubai

In conclusion, navigating Dubai’s tax environment requires specialized knowledge and expertise. Whether you’re a business looking to ensure compliance with VAT and corporate tax laws, or individual managing complex financial affairs, a tax consultant can provide invaluable assistance. By offering strategic advice, ensuring compliance, and helping you avoid costly mistakes, a tax consultant can save you time, money, and stress.

Dubai’s tax regulations are still evolving, and having a professional on your side ensures that you stay ahead of the curve. Don’t wait until you’re facing a tax audit or a compliance issue engages a tax consultant today to secure your financial future.

At Ample.ae, our team of experienced tax consultants is dedicated to helping businesses navigate the complexities of tax regulations. We understand the challenges that businesses face, especially with the introduction of corporate tax in 2024. Our tax consultants work closely with businesses in Dubai to ensure they comply with new tax laws, optimize tax strategies, and minimize tax liabilities. Whether you’re a startup or an established business, Ample.ae provides tailored solutions to meet your unique tax needs. Our expert tax consultants guide you through the process, offering proactive advice that aligns with your long-term financial goals and helps you achieve business growth.