We Offer

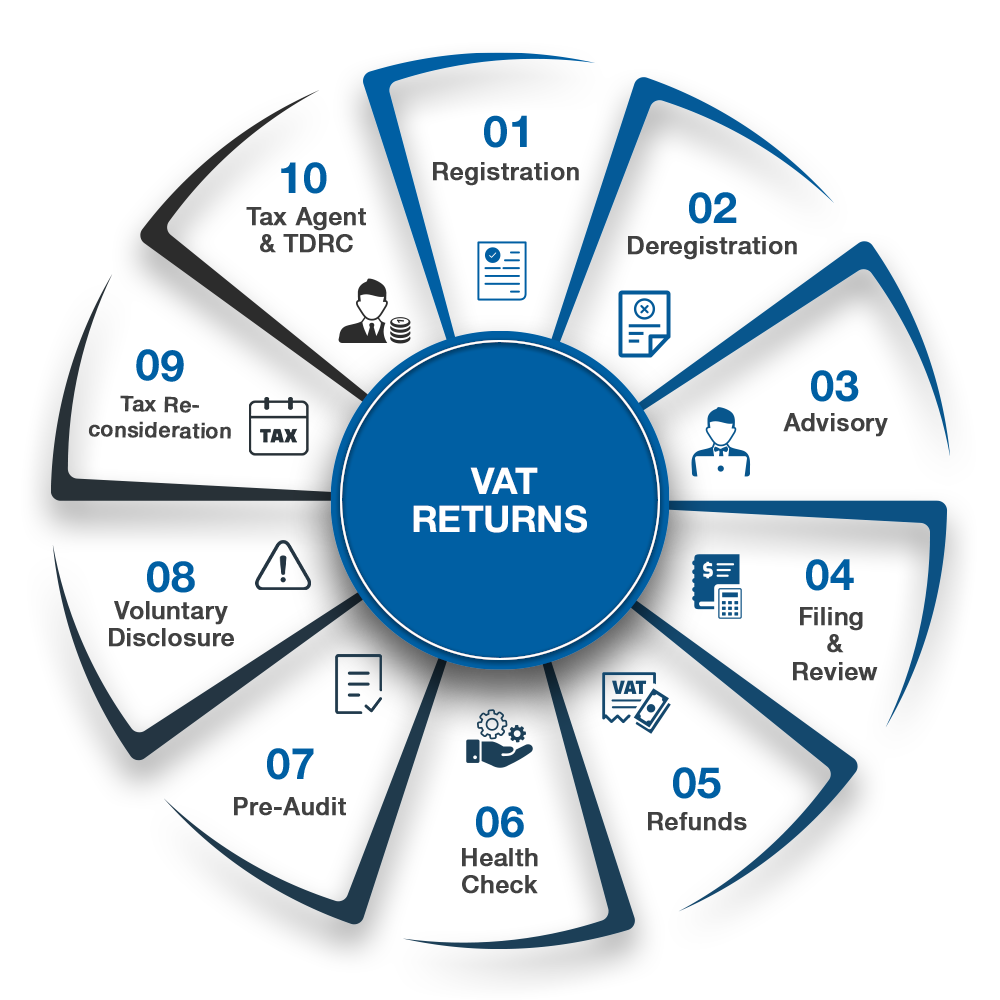

VAT Returns

At Ample Inc., we specialize in helping businesses comply with tax regulations in the UAE, offering seamless VAT registration, VAT return filing, and tax return services. Whether you are a new or established business, we handle all aspects of tax compliance, making the process simple and hassle-free for you.

VAT Registration, VAT Return UAE, and Tax Return Filing Services

01.

VAT Registration in UAE

Ensure timely and accurate VAT returns with Ample Inc. Our expert team helps businesses navigate UAE VAT regulations, ensuring compliance, avoiding penalties, and maximizing refunds. Let us handle your VAT filings while you focus on growing your business.

If your business meets the required turnover, VAT registration is mandatory. We simplify the process, guiding you step by step and ensuring all documents are submitted correctly and on time. Avoid delays, errors, and penalties with our professional assistance. For more information on VAT registration and filing requirements, visit UAE VAT regulations.

02.

Easy VAT Return Filing in UAE

Filing your VAT return on time is crucial to avoid penalties in the UAE. At Ample Inc., we manage the entire VAT return process, ensuring your returns are prepared accurately and submitted on time. This eliminates the stress of navigating complex tax laws or risking costly errors. With our support, you can focus on running your business while we ensure full compliance with VAT regulations.

Additionally, we offer comprehensive support, including tax filing services for other business taxes, ensuring your operations remain fully compliant. Our experts assess your VAT systems for potential risks, improving your overall tax strategy and reducing the chances of errors or audits.

03.

Tax Return Filing Services

Filing your VAT return on time is crucial to avoid penalties in the UAE. At Ample Inc., we manage the entire VAT return process, ensuring accurate preparation and timely submission, so you can focus on your business.

In addition to VAT, we offer comprehensive tax return filing services for all required taxes. Our experts ensure full compliance with tax laws, helping you avoid penalties and minimize liabilities. We handle everything from preparation to filing, saving you time and resources.

We also assess your VAT systems to identify potential compliance risks and optimize your tax strategy. Our proactive approach ensures your business stays audit-ready, with minimized risks and maximized tax savings. Let us streamline your tax processes while you concentrate on growing your business.

Don’t wait till you receive the penalties or fine notices with your non-professional freelancer accountants!

Are you facing difficulties in filing your VAT returns?

Ensure timely and accurate VAT returns with Ample Inc. Our expert team helps businesses navigate UAE VAT regulations, ensuring compliance, avoiding penalties, and maximizing refunds. Get professional services that allow your business to run smoothly and claim returns with ease.

Be a part of the successful choice for businesses to hire our top-tier accounting services to file your VAT returns, claim refunds, and avoid penalties. Focus on growing your business while we handle the complexities of VAT.

You focus on your business!

Fixed Asset Register & Asset Tagging

We assess your VAT systems to identify potential compliance risks, including record-keeping and invoicing practice.

VAT Registration

Our VAT specialists guide you through registration, ensure compliance, and review financial records to avoid discrepancies.

Account Reconcilliation

Our VAT specialists guide you through registration, ensure compliance, and review financial records to avoid discrepancies.

Inventory Stock Counting

Our comprehensive analysis evaluates your company’s VAT compliance, covering input/output ledgers, record-keeping, transactions, and invoices.

VAT Pre-audit

Our knowledgeable VAT experts educate clients and finance teams on how tax laws affect their business, helping them navigate the complexities of VAT compliance.