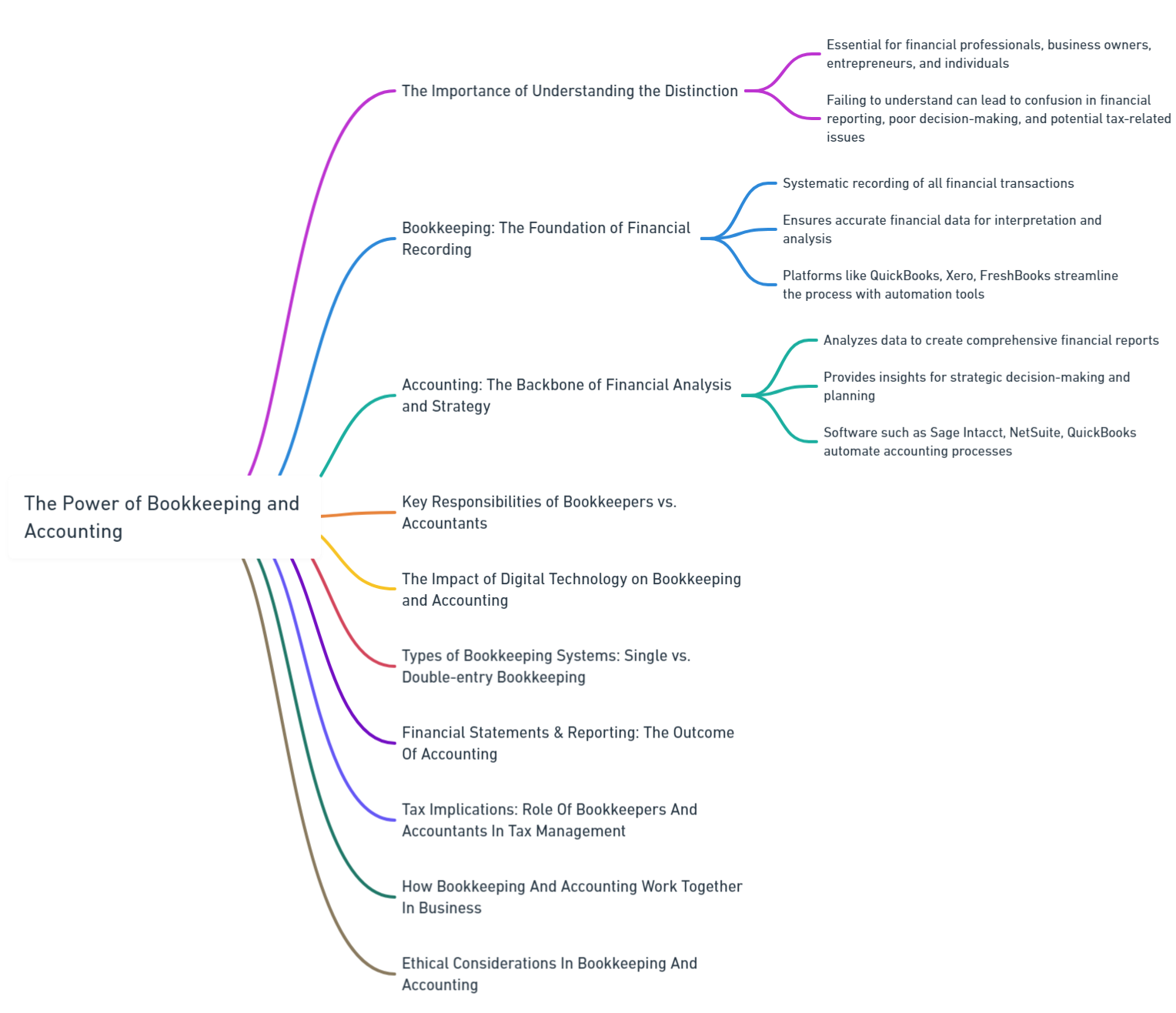

Understanding the Distinction Between Bookkeeping and Accounting

Understanding the difference between accounting and bookkeeping is essential not only for financial professionals but also for business owners, entrepreneurs, and individuals managing personal finances. Both roles are crucial in managing the financial aspects of any organization, and yet they serve distinct purposes. Failing to understand the differences can lead to confusion in financial reporting, poor decision-making, and potential tax-related issues.

Imagine running a small business where bookkeeping and accounting work hand in hand to ensure financial success. Your bookkeeper meticulously records every sale, purchase, and transaction, while your accountant uses that data to create detailed reports and offer insights into your financial health. Just like building a house, bookkeeping lays the foundation by tracking every detail, while accounting constructs the structure, analyzing the data and providing strategic advice for growth.

Without bookkeeping and accounting, businesses would struggle to keep track of their financial activities and make informed decisions. Bookkeeping records every transaction, but without accounting, those financial records wouldn’t be translated into actionable insights. For instance, while bookkeeping might show $100,000 in sales, accounting would analyze the data, subtract expenses, and determine whether the business was truly profitable by evaluating cash flow.

Understanding the distinction between bookkeeping and accounting is crucial for anyone involved in financial decision-making, whether you’re a sole proprietor managing your own bookkeeping and accounting or a CEO overseeing the company’s financial department.

Bookkeeping: The Foundation of Financial Recording

Bookkeeping, often regarded as the bedrock of financial management, is the systematic recording of all financial transactions conducted by a business or individual. As David A. Vance explains in Financial Analysis and Decision Making (2003), “bookkeeping is the essential precursor to any financial analysis, ensuring that all financial data is captured accurately before it can be interpreted.” Without an accurate and detailed bookkeeping system, financial statements, tax filings, and overall financial reporting would be riddled with inaccuracies, leading to potential mismanagement and compliance issues.

At its core, bookkeeping involves recording daily transactions, categorizing them correctly, and ensuring that all financial accounts remain balanced. It’s a meticulous process that requires attention to detail, as even minor errors can snowball into significant financial discrepancies. In Bookkeeping Essentials by Steven M. Bragg (2010), the author notes, “Bookkeeping is not just about data entry; it’s about creating a foundation of financial integrity that will support strategic decisions.” This underpins the importance of bookkeeping for organizations of any size, whether it’s a small startup or a multinational corporation, as the accuracy of financial data shapes critical decision-making processes.

Take, for instance, the operations of a small retail store. Whether sales are made in person or online, each transaction needs to be documented. Additionally, other expenses, including rent, utilities, and inventory purchases, must be recorded and categorized correctly. A well-trained bookkeeper ensures that each transaction is accurately assigned to its proper category—be it sales revenue, cost of goods sold, or operating expenses—thus facilitating smooth financial reporting and analysis. As John Tracy outlines in Accounting for Dummies (2013), this accurate data is what enables accountants to generate detailed financial reports, allowing businesses to assess profitability and financial health.

In the digital age, bookkeeping is increasingly supported by automation tools, which significantly streamline the process. Software like QuickBooks, Xero, and FreshBooks have become industry staples, allowing businesses to manage their financial data with precision and efficiency. QuickBooks, developed by Intuit, is one of the most widely used tools, providing features for tracking income and expenses, generating reports, and managing payroll. In contrast, Xero focuses heavily on real-time financial monitoring and integration with third-party applications, making it particularly popular among startups and small businesses. FreshBooks, often favored by freelancers and small businesses, simplifies invoicing, time tracking, and expense management. According to a 2021 study by the International Federation of Accountants (IFAC), over 70% of small businesses utilize cloud-based bookkeeping software, highlighting the shift toward automated financial management systems.

These platforms not only ensure that transactions are accurately recorded but also provide real-time data that can be used for essential tasks like cash flow analysis, tax planning, and financial forecasting. As highlighted in The E-Myth Revisited by Michael E. Gerber (1995), “Automation in financial systems doesn’t just save time—it enhances the accuracy and reliability of the data businesses depend on.” Through automation, business owners and finance teams can access up-to-date financial information, which allows for more informed decision-making and improved financial strategy development.

Bookkeeping’s value goes beyond simple record-keeping; it forms the backbone of an organization’s financial integrity. Without it, businesses would struggle to maintain compliance, secure funding, or make strategic growth decisions. Thus, whether you’re an entrepreneur, small business owner, or finance professional, investing in efficient bookkeeping practices, guided by reliable software and a skilled team, remains an indispensable step toward long-term success.

Key Concepts Mapped Out in This Article

Accounting: The Backbone of Financial Analysis and Strategy

While bookkeeping focuses on recording transactions, accounting goes a step further by analyzing this data to create comprehensive financial reports. Accounting provides a holistic view of a company’s financial health, offering key insights that enable business owners and decision-makers to plan for the future. Accountants play an indispensable role in transforming raw financial data into actionable strategies. As explained in Financial Accounting Theory and Analysis by Richard G. Schroeder, accounting is not just about the numbers—it’s about interpreting those numbers to provide business-critical insights.

Accountants prepare vital financial statements like income statements, balance sheets, and cash flow statements. These reports serve as the foundation for assessing a company’s performance. As noted in The Basics of Finance by Pamela Peterson Drake, “Accounting turns a company’s day-to-day financial transactions into the financial health check-up that stakeholders rely on to make future decisions.” These documents are not just internal tools; they are used by investors, banks, and regulatory bodies to evaluate the company’s financial standing, determine its profitability, and assess its risk level.

Transforming Data into Actionable Insights

Accountants have the responsibility of interpreting the data recorded by bookkeepers, turning it into meaningful insights that influence business strategy. For instance, while a bookkeeper might log all the financial transactions of business— sales, expenses, payroll—an accountant will analyze this data to assess profitability, determine potential cost savings, and map out strategies for growth. Accounting for Decision Making and Control by Jerold Zimmerman emphasizes the critical role of accountants in helping businesses maintain competitiveness through their ability to offer strategic advice.

For example, if a company’s profit margins are shrinking, an accountant can analyze financial data to identify inefficiencies in production costs or overheads. If a business is considering expansion, the accountant will evaluate financial reports to assess whether the current financial position supports such a move, ensuring long-term sustainability.

The Importance of Financial Statements

One of the key responsibilities of accountants is the preparation of financial statements. These documents—income statements, balance sheets, and cash flow statements—are essential for both internal and external decision-making. Without these reports, a business would struggle to secure loans, attract investors, or meet tax obligations. Investors and banks rely heavily on financial statements to gauge whether a company is creditworthy or a good investment opportunity. In fact, in Financial Statements: A Step-by-Step Guide to Understanding and Creating Financial Reports by Thomas Ittelson, the author breaks down how financial statements are crucial for “businesses to effectively communicate their financial performance to stakeholders.”

Financial statements also help tax authorities understand a company’s financial position and tax liabilities, ensuring compliance with local regulations. Accurate accounting allows businesses to minimize errors, meet tax obligations, and avoid legal penalties.

Beyond Numbers: Forecasting and Strategic Planning

Accounting doesn’t stop at analyzing past performance. It also plays a vital role in forecasting future financial performance, budgeting, and tax planning. Accountants help businesses develop projections that can shape their growth strategies. In Management Accounting by Richard A. Friedlob, the importance of accounting for long-term decision-making is emphasized: “Without accurate forecasting and budgeting, businesses risk overestimating their financial stability.”

By analyzing trends in financial data, accountants can predict future revenues, assess the impact of potential investments, and develop strategies for reducing tax liabilities. This makes accounting a critical tool for long-term business planning, allowing companies to navigate complex financial landscapes and adapt to changing market conditions.

Technology in Accounting: Tools of the Trade

In the modern business world, accountants rely on advanced tools to perform these tasks efficiently. Software such as Sage Intacct, NetSuite, and QuickBooks are widely used to automate many accounting processes, from generating financial statements to tracking expenses and forecasting financial performance. According to a survey by the International Federation of Accountants (IFAC), over 60% of accounting professionals now use cloud-based solutions, a trend that is reshaping the industry by enhancing real-time data accessibility and collaboration.

These tools not only streamline the process but also improve accuracy, reducing the likelihood of errors that can arise from manual data entry. They allow accountants to focus on higher-level tasks, such as strategic financial planning, by automating routine calculations and generating reports with just a few clicks. As stated in Accounting Information Systems by George H. Bodnar, “Accounting tools have evolved into integrated systems that drive efficiency and provide accountants with the necessary data to support business strategies.”

Key Responsibilities of Bookkeepers vs. Accountants

While both bookkeepers and accountants work with financial data, their roles differ in scope and responsibility. Bookkeepers handle the day-to-day tasks of recording transactions, ensuring accurate financial records. On the other hand, accountants analyze that data, providing a more comprehensive view of the business’s financial health and offering strategic insights for informed decision-making.

Here’s a breakdown of their key responsibilities:

Bookkeepers:

- Record daily financial transactions (sales, purchases, expenses, etc.).

- Maintain accurate ledgers and financial records.

- Reconcile bank accounts and ensure that all transactions are accounted for.

- Handle payroll and ensure that employees are paid on time.

- Prepare basic financial statements for internal use.

Accountants:

- Prepare and analyze comprehensive financial statements (income statements, balance sheets, cash flow statements).

- Ensure compliance with tax laws and regulations.

- Provide strategic advice on financial planning, budgeting, and tax strategies.

- Conduct financial audits to ensure accuracy and compliance.

- Offer recommendations on improving financial processes and reducing costs.

While bookkeepers focus on maintaining accurate records, accountants take a broader view, providing insights that help businesses make strategic decisions. For example, while a bookkeeper might record all the expenses associated with running a business, an accountant would analyze those expenses to identify areas where costs can be reduced or efficiencies can be improved.

The Tools of the Trade: Software and Technologies in Bookkeeping and Accounting

The Impact of Digital Technology on Bookkeeping and Accounting

The advent of digital technology has dramatically transformed how both bookkeepers and accountants carry out their tasks. In the past, bookkeeping relied heavily on manual processes—paper ledgers, handwritten records, and calculations that were prone to human error. Similarly, accounting required extensive manual effort, with accountants spending hours performing calculations by hand. Today, with the rise of specialized software, both bookkeeping and accounting have become faster, more accurate, and highly efficient. As stated in Accounting Information Systems by George H. Bodnar, “Technology has revolutionized how financial professionals manage data, making manual methods obsolete and empowering businesses to achieve new levels of accuracy.”

Bookkeeping Tools: Efficiency and Real-Time Insights

For bookkeepers, software tools such as QuickBooks, Xero, and FreshBooks have become indispensable. These platforms automate many routine tasks, like tracking sales, expenses, and payroll, enabling businesses to handle bookkeeping with increased efficiency and precision. According to a report by Statista, QuickBooks leads the global market, used by over 4.5 million small businesses worldwide.

These tools also provide real-time insights into a company’s financial position, which is crucial for effective decision-making. As explained in The Art of Accounting by Ronald S. Gotcher, “Automation has made it possible for businesses to monitor their finances in real time, ensuring that they can manage cash flow more effectively and address any financial challenges as they arise.” With features like automatic bank reconciliations, invoicing, and expense tracking, these platforms ensure that bookkeepers can focus on maintaining accurate records while leveraging automation for routine calculations.

Accounting Tools: Advanced Analytics and Compliance

Accountants, on the other hand, use more advanced tools such as Sage, Oracle NetSuite, and Microsoft Dynamics to prepare complex financial reports, conduct audits, and ensure compliance with ever-changing regulatory standards. These platforms offer sophisticated analytics capabilities that allow accountants to delve deeper into financial data, providing insights that can help businesses optimize performance and meet strategic goals.

As detailed in Financial Accounting and Reporting by Barry Elliott and Jamie Elliott, “Modern accounting systems provide comprehensive tools that facilitate complex financial reporting, including integrated solutions for compliance, tax planning, and strategic forecasting.” Accountants can use platforms like Oracle NetSuite to prepare in-depth financial analyses, especially when a business is considering expansion, a merger, or major investment decisions. These tools not only automate the generation of detailed financial reports but also provide a granular view of sales trends, profitability, and cash flow, empowering accountants to offer data-driven recommendations.

Financial Planning with Oracle NetSuite

For example, consider a scenario in which a company is planning a major expansion. An accountant might use Oracle NetSuite to analyze the company’s financial data, focusing on key metrics such as sales trends, profitability, and cash flow. By drilling down into these areas, the accountant can assess whether the expansion is financially viable and how it should be financed. According to Strategic Financial Planning by William R. Lasher, “Sophisticated financial planning tools enable accountants to assess risk, forecast future performance, and ensure that strategic initiatives align with the company’s overall financial health.”

Technology as a Catalyst for Efficiency

Digital technology has forever altered the landscape of bookkeeping and accounting. Tools like QuickBooks, Xero, and FreshBooks empower bookkeepers to automate daily financial tasks while providing real-time insights into business operations. For accountants, advanced platforms such as Sage, Oracle NetSuite, and Microsoft Dynamics offer powerful analytics, compliance tools, and strategic planning capabilities. These digital solutions not only streamline processes but also allow financial professionals to provide businesses with actionable insights that drive long-term success. As noted in The Future of Finance: Adapting to Digital Transformation by Theodore Grossman, “The integration of technology into financial management is not just a trend it is an essential evolution that enables companies to stay competitive and agile in an increasingly data-driven world.”

Key Skills Required: Differences in Competency

While both bookkeepers and accountants work with financial data, their roles differ in scope and responsibility. Bookkeepers handle the day-to-day tasks of recording transactions, ensuring accurate financial records. On the other hand, accountants analyze that data, providing a more comprehensive view of the business’s financial health and offering strategic insights for informed decision-making.

Accountants, on the other hand, require a deeper understanding of financial principles, tax laws, and business strategy. They need to be able to analyze complex financial data, identify trends, and provide strategic advice to business owners. Accountants often pursue professional certifications like Certified Public Accountant (CPA) or Chartered Accountant (CA) to validate their knowledge and skills.

Both roles require strong ethical standards, as they are entrusted with sensitive financial information. Whether it’s ensuring that employees are paid correctly or that tax returns are filed accurately, both bookkeepers and accountants play a critical role in maintaining the financial integrity of a business.

How Bookkeeping and Accounting Work Together in Business

Bookkeeping and accounting are often seen as separate functions, but they are deeply interconnected. Bookkeepers provide the raw data that accountants use to analyze a company’s financial performance and make strategic recommendations. Without accurate bookkeeping, accountants would not have the data they need to prepare financial statements, file taxes, or provide advice.

In a typical business, bookkeepers record every financial transaction as it happens. This includes everything from sales and expenses to payroll and tax payments. At the end of each financial period (monthly, quarterly, or annually), the accountant takes this data and uses it to prepare financial reports, analyze the company’s performance, and provide recommendations for the future.

For example, let’s say a company is considering expanding its operations by opening a new location. The bookkeeper has recorded all the financial transactions related to the company’s current operations, including sales, expenses, and payroll. The accountant takes this data and analyzes it to determine whether the company has the financial resources to support an expansion. Based on the accountant’s analysis, the business owner can decide whether to move forward with the expansion or hold off until the company is in a stronger financial position.

Single vs. Double-entry Bookkeeping

There are two main types of bookkeeping systems: single-entry and double-entry bookkeeping.

- Single-entry bookkeeping is the simplest form of bookkeeping and is often used by small businesses or individuals. In this system, each transaction is recorded only once, either as income or an expense. For example, if a business receives payment for a service, the payment is recorded as income. This system is easy to use but provides limited information about the financial health of the business.

- Double-entry bookkeeping, on the other hand, is more complex and is used by most businesses. In this system, each transaction is recorded twice: once as a debit and once as a credit. This ensures that the accounting equation (Assets = Liabilities + Equity) always remains balanced. Double-entry bookkeeping provides a more accurate picture of a company’s financial health and helps to prevent errors.

For example, let’s say a company purchases new equipment for $10,000. In a double-entry system, this transaction would be recorded as a debit to the equipment account and a credit to the cash account, ensuring that the company’s assets and liabilities remain in balance.

Financial Statements and Reporting: The Outcome of Accounting

One of the primary functions of accounting is to produce financial statements, which provide a comprehensive overview of a company’s financial performance. These include the Income Statement (Profit and Loss Statement), Balance Sheet, Statement of Cash Flows, and the Corporative Statement (often referred to as the Statement of Retained Earnings or Equity). Let’s explore each of these statements in detail:

1. Income Statement (Profit and Loss Statement)

The income statement is a financial report that shows a company’s revenues and expenses over a specific period, typically quarterly or annually. It highlights the company’s profitability by calculating the net income or net loss.

- Revenue: The total income generated from business operations.

- Expenses: The costs incurred during the period, including cost of goods sold (COGS), operating expenses, interest, and taxes.

- Net Income: The final profit or losses after all expenses have been deducted from revenues.

This statement helps business owners and stakeholders assess whether the business is making money or operating at a loss, guiding strategic decisions for improving profitability.

2. Balance Sheet

The balance sheet is a snapshot of a company’s financial position at a given moment in time. It reflects what the company owns and owes, as well as the shareholders’ equity.

- Assets: Everything the company owns, including cash, inventory, property, and equipment.

- Liabilities: Debts and obligations, such as loans, accounts payable, and other financial commitments.

- Equity: The residual interests in the company after liabilities are deducted from assets. Equity represents the owners’ or shareholders’ claims to the company’s assets.

The balance sheet provides insight into a company’s liquidity, solvency, and capital structure. It ensures that the accounting equation Assets = Liabilities + Equity is always balanced.

3. Statement of Cash Flows

The cash flow statement tracks the cash entering and leaving a company over a specific period. It is divided into three sections:

- Operating Activities: Cash generated or spent in the course of regular business operations, such as sales, payments to suppliers, and wages.

- Investing Activities: Cash related to the purchase or sale of assets, such as property or equipment.

- Financing Activities: Cash flows related to borrowing, repaying loans, issuing equity, or paying dividends.

The cash flow statement helps businesses manage their liquidity by understanding how they generate and use cash. It is crucial for ensuring that the company can meet its short-term obligations.

4. Corporative Statement (Statement of Retained Earnings)

This statement, often referred to as the Statement of Retained Earnings or Statement of Equity, shows the changes in the company’s equity during a specific period. It connects the balance sheet and the income statement by explaining how the company’s profits are utilized.

- Retained Earnings: The portion of net income that is reinvested in the company rather than paid out as dividends.

- Dividends: Distributions of earnings to shareholders.

- Other Changes in Equity: Includes capital contributions, share buybacks, and other transactions impacting the company’s equity.

Accountants use these financial statements to assess how well a business is performing and to make recommendations for improvements. For example, if a company’s cash flow statement shows that it is consistently spending more money than it is bringing in, the accountant might recommend cutting costs or finding new sources of revenue to improve liquidity.

Tax Implications: Role of Bookkeepers and Accountants in Tax Management

Taxes are a critical aspect of financial management, and both bookkeepers and accountants play important roles in ensuring that businesses comply with tax laws and regulations.

Accounting and bookkeeping professionals are responsible for recording all the financial transactions that will eventually be used to prepare tax returns. This includes tracking income, expenses, and payroll, as well as ensuring that all tax-related documents are properly filed. For example, those involved in accounting and bookkeeping might ensure that all business expenses are categorized correctly so that they can be deducted from the company’s taxable income.

Accountants, on the other hand, are responsible for preparing tax returns and ensuring that businesses comply with all tax laws. They also provide strategic advice on how to minimize tax liabilities by identifying deductions, credits, and other tax-saving opportunities. For example, an accountant might recommend that a business invest in energy-efficient equipment to take advantage of tax credits for renewable energy.

In addition to preparing tax returns, accounting and bookkeeping professionals also help businesses plan for the future by providing advice on tax strategies. For example, they might recommend that a business restructure its operations to take advantage of lower tax rates in certain jurisdictions or set up retirement plans to reduce taxable income.

Bookkeeping and Accounting in Different Industries

While the core principles of bookkeeping and accounting remain the same across all industries, the specific needs and challenges can vary significantly depending on the type of business. For example, a construction company will have very different bookkeeping and accounting needs compared to a retail store or a tech startup. Understanding these industry-specific nuances is crucial for providing accurate financial management.

In the construction industry, bookkeeping involves tracking costs for multiple ongoing projects, managing contracts, and ensuring that all project expenses are recorded accurately. Construction companies also need to deal with long-term contracts and complex billing structures, which means that their bookkeeping must account for progress payments, retentions, and the allocation of overhead costs to specific projects.

Accounting in the construction industry, meanwhile, involves preparing detailed cost reports for each project, ensuring that project budgets are adhered to, and analyzing profitability. Accountants in this industry also need to be familiar with construction-specific tax rules, such as the treatment of capital expenditures and depreciation of heavy machinery.

In contrast, a retail business will focus more on managing inventory, tracking sales taxes, and handling a high volume of daily transactions. Bookkeepers in retail need to maintain accurate records of sales, returns, and inventory purchases. They also need to manage vendor relationships and ensure that all supplier invoices are paid on time.

For accountants in retail, analyzing cash flow is critical to ensuring the business has enough liquidity to cover operating expenses. They must also prepare financial reports that track key performance indicators (KPIs) such as gross profit margin, inventory turnover, and sales trends. This helps business owners understand how their store is performing and make decisions about inventory purchases and marketing strategies.

The tech industry, particularly startups, often faces unique financial challenges. Many startups operate at a loss in their early years, relying on external funding to stay afloat. For bookkeepers, this means tracking capital investments, loans, and expenditures related to research and development (R&D). Startups also tend to have complex equity structures, which need to be recorded accurately.

For accountants working in tech startups, one of the key tasks is preparing financial reports for investors and ensuring that the company complies with regulatory requirements related to fundraising. This involves managing the company’s cap table (which shows the ownership of shares) and preparing financial projections that demonstrate how the business plans to achieve profitability.

Ethical Considerations in Bookkeeping and Accounting

Ethics play a crucial role in both accounting and bookkeeping. Given that both professionals in accounting and bookkeeping are responsible for handling sensitive financial information, they are held to high ethical standards. Whether it’s ensuring the accuracy of financial records or maintaining the confidentiality of client information, those involved in accounting and bookkeeping must act with integrity at all times.

For example, bookkeepers need to ensure that all transactions are recorded honestly and accurately. Failing to do so could result in misleading financial statements, which could harm the business or lead to legal consequences. Similarly, accountants must ensure that they are adhering to ethical guidelines when preparing financial reports, filing taxes, or offering strategic advice. Inaccurate or fraudulent reporting can lead to severe penalties, including fines, lawsuits, and damage to the company’s reputation.

One of the most well-known examples of unethical accounting practices is the Enron scandal, where executives and accountants at the energy company engaged in fraudulent accounting to hide the company’s financial losses. This scandal led to the collapse of Enron, legal action against its executives, and the dissolution of its accounting firm, Arthur Andersen. It also resulted in stricter regulations for financial reporting, such as the Sarbanes-Oxley Act.

Professional organizations like the American Institute of CPAs (AICPA) and the Institute of Management Accountants (IMA) have established ethical standards that accountants must follow. These guidelines emphasize the importance of honesty, transparency, and accountability in all financial dealings.

Bookkeepers, though not typically subject to the same regulatory scrutiny as accountants, must also adhere to ethical standards, particularly when it comes to maintaining the confidentiality of financial data. For example, bookkeepers handling payroll must ensure that employee information, such as Social Security numbers and salary details, is kept secure and private.

In both bookkeeping and accounting, acting with integrity is essential for maintaining trust with clients, stakeholders, and the public.

Understanding the distinction between accounting and bookkeeping is crucial for businesses to ensure accurate financial management. Bookkeeping focuses on recording daily transactions, while accounting analyzes and interprets this data to provide financial insights and strategic advice. At Ample Inc., we specialize in both accounting and bookkeeping services, helping businesses maintain organized records and gain a clear understanding of their financial health. Our team ensures accurate transaction tracking, tax compliance, and insightful financial reporting, enabling businesses to make informed decisions and achieve long-term growth. Let Ample Inc. streamline your accounting and bookkeeping needs for optimal business success.